The private markets just closed one of their most active quarters to date.

In Q2 2025, investor appetite surged following the public debuts of Circle (NYSE: CRCL) and CoreWeave (NYSE: CRWV), along with Figma’s long-awaited S-1 filing. As IPO chatter returned, so did competition for the top pre-IPO names. Prices climbed. Activity deepened. And a new batch of companies crossed critical commercial milestones.

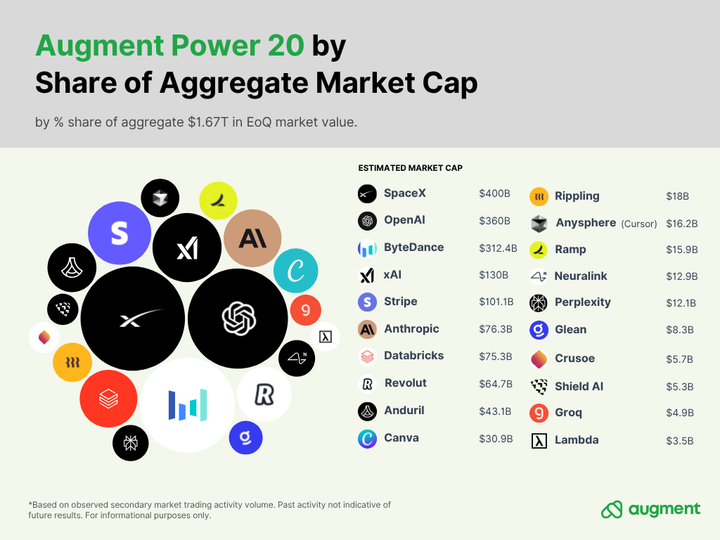

Each quarter, our capital markets team releases the Power 20 — a proprietary ranking of the top pre-IPO companies, built from over 50,000 data points on trading activity, price movement, company fundamentals, and investor sentiment.

Here’s what stood out this quarter.

A $1.67 trillion snapshot of the private market

The top 20 pre-IPO companies now command a combined market cap of $1.67 trillion — up nearly 47% from $1.14 trillion just six months ago. That figure rivals the GDP of most nations.

The top six — SpaceX, Anduril, Anthropic, OpenAI, Databricks, and Stripe — alone account for 57% of that value. These same six also represented 25% of total platform activity, marking the third straight quarter of intense investor focus at the top, though down from 32% in Q1. But growth wasn’t confined to the top: the bottom 15 names outpaced the top five in average price gains (17.4% vs. 7.6%), hinting at a broadening market.

.png)

The AI supercycle is still gaining steam

AI companies now make up half of the Power 20. These ten companies alone account for:

- 55% of the group’s total market cap

- 55% of Power 20 activity

- 24% of all platform-wide activity

.png)

Leaders like Anthropic (+567% YoY revenue growth) and OpenAI (+244% YoY) continue to post staggering fundamentals. Meanwhile, emerging entrants like Cursor AI (Anysphere) jumped into the Power 20 after growing revenue 9,900% in 2024 and posting the largest share price gain of the quarter at +63.3%.

Other notable AI risers in Q2:

- Perplexity: +6.7% share price, renewed M&A interest from Apple

- xAI: +1,900% revenue growth and was the fourth most-active name on the platform

- Glean: +16.8% share price

- Groq: +12.6% share price

The net result? For the third quarter in a row, AI names are the dominant force in pre-IPO markets — not just by hype, but by price.

Defense tech: Quietly commanding attention

AI may be soaking up headlines, but defense and aerospace continue to punch above their weight.

SpaceX, Anduril, and Shield AI represent just three names, but together they accounted for 22.5% of all Power 20 activity.

- SpaceX: remains #1 despite a 7.6% price dip, thanks to its unmatched scale ($14.2B reported revenue) and dominant activity volume.

- Anduril: saw the highest price growth among the top five (+19.1%), buoyed by a $2.5B Series G and 138% revenue growth.

- Shield AI: entered the Power 20 at #20, with real-world battlefield performance driving investor interest.

Defense remains one of the few sectors showing clear investor conviction outside of AI, with consistent activity and capital formation.

Most active names: The real market movers

Looking purely at overall bid/ask and trade activity, the most active names in Q2 were:

Notably, Apptronik, a robotics startup, was the second most active name on the platform yet remains unranked. It leads our “Companies to Watch” list and appears poised to enter the Power 20 soon.

Price gainers: Anysphere (Cursor) breaks out

While share price isn’t everything, it’s often a lagging indicator of deeper market dynamics.

Top price gainers this quarter:

- Anysphere (Cursor AI): +63.3%

- Revolut: +43.9%

- Crusoe: +34.2%

- Rippling: +28.7%

- Anduril: +19.1%

Cursor was the single highest gainer by a large margin, capping off a breakout quarter.

New entrants & departures

In:

- Lambda (#17): Riding a partnership with NVIDIA and a GPU marketplace boom

- Anysphere / Cursor AI (#18): Top gainer of the quarter

- Shield AI (#20): Activity tripled over Q1 from an increased defense expenditure by the US

Out:

- Figma: IPO filing removed it from private rankings

- Scale AI: Strategic shifts following Meta acquisition

- Discord: Internal turmoil, slipping valuation

Methodology: What makes a Power 20 name

Our proprietary rankings blend:

- Total activity (bids, asks, trades)

- Trading volume and bid-ask ratios

- Share price change and volatility

- Revenue and revenue growth estimates (via Sacra)

- Historical performance for momentum

Each data point is normalized, weighted, and scored to balance short-term trends against long-term traction. No single factor dominates.

Why it matters

The Power 20 is a go-to pulse check for private market investors.

In an opaque ecosystem where some secondary trades happen peer-to-peer or through brokers, Augment provides real-time execution and real price discovery. The Power 20 aims to bring more clarity to the private markets. A proxy for which companies are attracting capital, generating revenue, and inspiring confidence.

Follow the activity. Track the movement. And get ahead of what might just be the next big private or public name.

*Securities transactions are executed on Augment Capital, LLC's ATS and offered through Augment Capital, LLC (member FINRA/SIPC)

Important Disclosures: Investing in private securities involves substantial risk, including the potential loss of principal. Private securities are typically illiquid, have limited pricing transparency, and often require longer holding periods. These investments are available exclusively to qualified accredited investors and offer no guarantee of returns. Projections and forward-looking statements in this content are based on current market conditions and assumptions. Actual results may vary significantly and past performance does not indicate future outcomes. Views are those of the author. Additionally, past performance of private securities does not indicate or predict future results.